The net present vaue of an investment is the difference between the present value of future income and the present vale of future costs.

Initial research for Brook Bicycles's Columbus project has identified three possible locations for a new retail outlet. Click here to download a PDF of the background to the project and the basic financial data relating to the three locations.

This worked example will use the data to compare the net present value of two of the sites over 5 years.

The Cascades

The table below takes the financial data for the Cascades development and calculates the net present value over five years using a discount rate of 8%. All figures are in thousands.

| Year | Net cash flow | Discount factors @ 8% | Discounted net cash flow |

|---|---|---|---|

| 0 | -595 | 1.000 | -595.00 |

| 1 | 400 | 0.926 | 370.40 |

| 2 | 410 | 0.857 | 351.37 |

| 3 | 436 | 0.794 | 346.18 |

| 4 | 471 | 0.735 | 349.19 |

| 5 | 486 | 0.681 | 330.97 |

| NPV = | 1,153.11 |

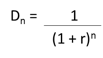

Discount factors are calculated using the formula:

Individual discount factors can be calculated or read from a table.

Click here to download an Excel spreadsheet that calculates the discount factors up to 10% for 10years.

Where:

Dn = discount factor

r = discount rate

n = number of years ahead

What next?

See the full investment appraisal including several appraisal techniques and a final consolidation. |