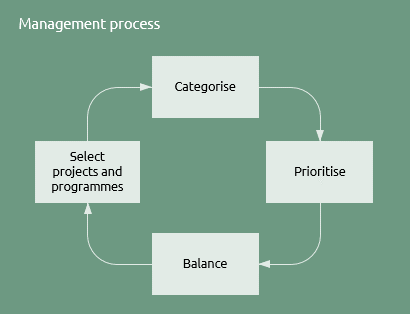

This process deals with the high level management of the portfolio. The activities will be applied according to the type of portfolio and its context. Its goals are to:

- assess the suitability of projects and programmes for inclusion in the portfolio;

- maintain a beneficial and manageable mix of projects and programmes.

Although primarily a portfolio management process, the activities described here are also relevant to a version of the delivery process for large, complex programmes.

Click on the components of the diagram for more detail

Select projects and programmes

The main criterion for inclusion of a project or programme in a standard portfolio may be simply that it exists. This is the case where the host organisation has created a standard portfolio with the primary purpose of improving the effectiveness of project and programme management through consistency and co-ordination.

Structured portfolios may have a quite sophisticated system for selecting projects and programmes. In this case the portfolio is designed to achieve strategic organisational objectives that could be achieved by various means. Some structured portfolios may have a top down approach to defining the projects and programmes they will contain.

However, many more will have a more bottom up approach where the host organisation as a whole is able to identify potential pieces of work and present these to the portfolio management team for inclusion.

In this latter case, the portfolio must have a filtering procedure aligned to the project and programme life cycle. Many ideas will be mandated, some of these will be rejected at the end of the identification process . More will be rejected at the end of the definition process, with the remaining projects and programmes being re-evaluated at the end of each stage or tranche.

The portfolio must be rigorous in testing business cases for their ability to deliver benefits that are consistent with the strategic objectives. In large portfolios a scheme of delegation may be used to allow decisions to be made at different levels of authority. For example, at a lower level a senior manager or panel may have authority to approve projects up to £1million in value to a total of £10 million whereas project or programmes above that value would have to be approved by the portfolio sponsor.

The remaining activities in this process are all designed to help with maintaining a viable portfolio of projects and programmes. Whilst these are most applicable to a structured portfolio that is defined by strategic objectives, available resources and possibly regulatory or legislative factors, they can also useful in the context of a standard portfolio.

Back to diagram

Categorise

Categorisation is useful on particularly large portfolios. Categories are defined to make it easier for senior decision makers to understand the nature or the portfolio. Typical categories might align with specific strategic objectives, alternatively they may identify characteristics such as mandatory or discretionary; short or long term investments; high or low risk; significant or marginal change and so on.

Each project or programme may belong to multiple categories giving the opportunity to review the portfolio components according to different criteria. This is particularly useful when considering the balance of the portfolio.

The procedures used in selecting projects and programmes may differ for different categories as may the approach to governing them.

Back to diagram

Prioritise

All portfolios are subject to finite resources, whether it be financial, logistical, mechanical or human. When multiple initiatives compete for finite resources, conflicts will occur and choices will need to be made.

Prioritisation helps with making the right choices. The first priority of any organisation is to continue to exist. Naturally, for example, any project that is designed to comply with new legislation without which a company would be unable to continue trading will be given high priority.

Work may be prioritised based on measures of financial return, both in terms of the value of benefits, the timescale in which they will be realised and the certainty associated with achieving them.

In a structured portfolio, the strategic objectives may have different priorities. Projects and programmes will inherit the priority of the objectives they fulfil.

Whatever prioritisation mechanism is used, the result will guide the initial selection of projects and programmes and subsequently the management of resource conflicts between multiple projects and programmes.

Back to diagram

Balance

Categorisation and prioritisation help the management team and senior managers (perhaps Board members) understand the dynamic nature of the portfolio. This, in turn, should help with balancing the portfolio.

For example, categorisation may identify that too many initiatives are in the ‘high risk’ category. It may be that this comes about as a consequence of prioritising high reward projects and programmes. Prioritisation may identify the high priority strategic objectives but the categorisation may show that these are receiving a disproportionate amount of the investment available.

Whereas categorisation and prioritisation can be relatively objective, finding the right balance can be more subjective. It is driven by the context and values of the host organisation. In a young and dynamic business it may be acceptable and feasible to have a high proportion of the portfolio generating significant change. In an entrepreneurial organisation it may be desirable to have high overall levels of risk (with associated potential for high return). In more established organisations, regulated industries or not-for-profit organisations these approaches may be unacceptable.

Ultimately, every organisation must adjust the portfolio of projects and programmes to have a balance of factors with which it is comfortable.

Even in a portfolio that is carefully balanced at the outset, it is possible that it can become unbalanced over time. This could conceivably lead to premature closure of a projects or programmes. If aspects of the associated business case remain justifiable then ways should be sought to retain the most valuable benefits while restoring the balance of the portfolio.

Back to top