If you are new to the idea of Team Praxis, please read our introduction to the concept before using the table below to improve your communications with team members, stakeholders and anyone else involved in your project, programme or portfolio.

If you are new to the idea of Team Praxis, please read our introduction to the concept before using the table below to improve your communications with team members, stakeholders and anyone else involved in your project, programme or portfolio.

When implementing portfolio management:

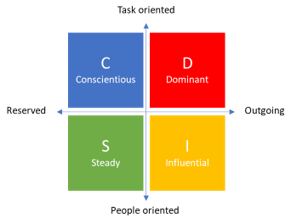

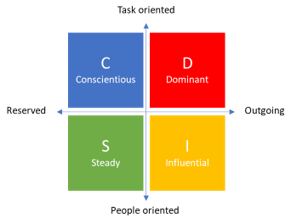

Concientious behaviour would typically propose or want to see: Concientious behaviour would typically propose or want to see:

-

a rational explanation of what portfolio management is aiming to achieve; -

a consistent and systematic approach to initiating, governing, managing and co-ordinating a portfolio; -

a long term commitment to maintaining and monitoring the portfolio; -

tangible and detailed financial benefits which are measurable and can be shown to be realised from the investment. Someone exhibiting concientious behaviour would typically be perceived as: -

increasing bureaucracy and delay when insisting on evidence and facts to justify the adoption of portfolio management; -

discounting intangible / non-financial benefits and relying solely on tangible / financial benefits for the justification. |  Dominant behaviour would typically propose or want to see: Dominant behaviour would typically propose or want to see:

-

action taken quickly to complete the initiation process; -

a pragmatic view of the achievability of the perceived value; -

that they have maximum freedom to take action as they believe necessary to complete the initiation process; - resources being identified and committed to portfolio management in the short term.

Someone exhibiting dominant behaviour would typically be perceived as: -

focusing on short term wins and the demonstration of value as quickly as possible; -

focused primarily on quantifiable / financial benefits of portfolio management and potentially dismissing those benefits that cannot be described in this way. |

Steady behaviour would typically propose or want to see: Steady behaviour would typically propose or want to see:

-

key individuals are given the opportunity to input and influence the decision; -

equal consideration to intangible and non-financial benefits when considering the potential value; -

a clear understanding of the positive and negative impacts on people of introducing portfolio management; -

caution regarding how quickly portfolio management can be adopted especially where it involves a change in people’s attitudes and behaviours. Someone exhibiting steady behaviour would typically be perceived as: -

being empathic to the impact of the proposed changes on people; -

a leader who wishes to ensure that there is adequate investment in managing the change associated with implementing portfolio management; -

focusing on the attitudes and behaviours of those impacted versus the tangible benefits of adopting portfolio management; -

focusing on dis-benefits of portfolio management as well as benefits. |  Influential behaviour would typically propose or want to see: Influential behaviour would typically propose or want to see:

-

clear communication on the importance of portfolio management and its role in improving team motivation and thereby performance; -

short term responsibilities for portfolio management identified and clarified with people; -

encourage early interaction within the team and with stakeholders as part of the adoption process; - a broad view of the benefits of portfolio management adoption - intangible and non-financial.

Someone exhibiting influential behaviour would typically be perceived as: -

over-estimating the value in some intangible and non-financial benefits of portfolio management to the organisation; -

being overly optimistic regarding the ease with which portfolio management can be adopted. |

When operating portfolio management processes:

Concientious behaviour would typically propose or want to see: Concientious behaviour would typically propose or want to see:

-

the consistent use across the portfolio of methodical, fact-based tools and techniques that provide quantitative data to facilitate objective decision making; -

principles and details of the way valuation tools should be used; -

a methodical and evidence based approach to measuring the before and end-states, which objectively demonstrates the value of the portfolio; -

a high proportion of information that is robust, verifiable and against which measurement can take place. -

performance quantitatively judged during the management process; -

a comprehensive and robust portfolio plan linking outputs to the necessary changes that will realise the benefits and all steps for a successful transition. |  Dominant behaviour would typically propose or want to see: Dominant behaviour would typically propose or want to see:

-

the use of portfolio management tools and techniques that are quick to implement and provide short term value; -

a focused set of data around which logical decisions can be made; -

that lessons learned are taken into account and acted upon; -

quantitative rather than qualitative output from the portfolio processes that allows speedy decision making; -

flexible approaches which are there to act as guidance for those responsible for implementing the processes; -

sufficient and verifiable information against which measurement can take place and progress can be easily monitored across the portfolio -

accountabilities for managing the portfolio processes made clear and formally recorded; -

timely monitoring and control to ensure that people are being held to account against their responsibilities. |

Steady behaviour would typically propose or want to see: Steady behaviour would typically propose or want to see:

-

the involvement of people, ideally through one-to-one discussions in the selection, categorisation, prioritisation and balancing phases; -

benefits and dis-benefits that are people centric (often intangible and non-financial); -

communication with people from other portfolios to obtain lessons learned, focusing on the impact on people of the practice of portfolio management; -

the use of qualitative techniques as well as quantitative; -

comprehensive portfolio processes that clearly identify responsibilities including their own; -

an approach that has been agreed by all parties with clear responsibilities that are fairly allocated across the portfolio management team; -

resources being deployed to communicate with all those impacted by the decisions made through the management process; -

a focus on minimising the negative impact on people and ongoing operations if prioritisation / balancing results in major changes within the business. |  Influential behaviour would typically propose or want to see: Influential behaviour would typically propose or want to see:

-

the involvement of team members and stakeholders through discussion and workshops to ensure a broad mix of views is considered; -

communication with people from other portfolios, typically in a workshop setting, to obtain lessons learned -

less focus on dis-benefits where they don’t consider them significant; -

information for the portfolio processes created with minimal level of formality; -

resources being deployed to ensure sufficient performance information is available across the portfolio; -

the adoption and use of qualitative techniques for valuing benefits; -

flexible processes that are there for guidance allowing people to tailor and adapt; -

effort put to marketing and communicating the portfolio to a broad audience to ensure their support; -

a personal role in this, potentially acting as a spokesman for the process and helping people to understand the impact of the changes implemented by the portfolio -

a flexible and simple means of monitoring actions. |

Thanks to Donnie MacNicol of Team Animation for providing this page.

If you are new to the idea of Team Praxis, please read our introduction to the concept before using the table below to improve your communications with team members, stakeholders and anyone else involved in your project, programme or portfolio.

If you are new to the idea of Team Praxis, please read our introduction to the concept before using the table below to improve your communications with team members, stakeholders and anyone else involved in your project, programme or portfolio.

Concientious behaviour would typically propose or want to see:

Concientious behaviour would typically propose or want to see: Dominant behaviour would typically propose or want to see:

Dominant behaviour would typically propose or want to see: Steady behaviour would typically propose or want to see:

Steady behaviour would typically propose or want to see: Influential behaviour would typically propose or want to see:

Influential behaviour would typically propose or want to see: