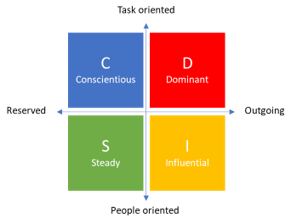

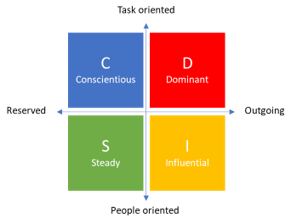

If you are new to the idea of Team Praxis, please read our introduction to the concept before using the table below to improve your communications with team members, stakeholders and anyone else involved in your project, programme or portfolio.

The goals of financial management are to:

- estimate the cost of achieving the objectives;

- assess the viability of achieving the objectives;

- secure funds and manage their release throughout the life cycle;

- set up and run financial systems;

- monitor and control expenditure.

When implementing these goals people with different character traits would perceive financial management plans and techniques in different ways.

Concientious behaviour would typically propose or want to see: Concientious behaviour would typically propose or want to see:

-

cost estimates which are conservative, validated and backed up by research; -

a rigorous assessment of the achievability and viability of the objectives; -

securing the funds as early as possible to allow informed decisions to be made; -

planned and controlled release of funds ensuring that they are being deployed only when necessary; -

robust financial systems which provide a consistent and systematic approach to financial management agreed detailed baselines; -

detailed monitoring, regular reporting and robust control of expenditure against the agreed baseline. Someone exhibiting concientious behaviour would typically be perceived as: -

formal and objective; -

sticking to the agreed financial management processes; -

wishing to see validated financial information being used and before making a decision; -

cautious and requiring time to make considered decisions; -

demanding in terms of the information they request; -

favouring an iterative approach to improving cost estimates and budgets. |  Dominant behaviour would typically propose or want to see: Dominant behaviour would typically propose or want to see:

-

cost estimates challenged to confirm their validity and whether savings can be made; -

a high-level assessment of the viability of achieving the objectives and quick decision to allow approval to be given; -

securing funds at the earliest point to allow work to commence; -

the release of funds on a just in time basis to maximise the value obtained but without impacting the work; -

a simple financial system which provides reliable and concise information against which decisions can be made; - a simple means of monitoring and control to ensure the efficient use of funds and the maximum value from the work being delivered.

Someone exhibiting dominant behaviour would typically be perceived as: -

wishing to see efficient use of funds; -

working broadly to the process until they believe it hinders progress; -

dismissive of activities that they perceive as unnecessary and bureaucratic; -

decisive when choices need to be made even when there is uncertainty. |

Steady behaviour would typically propose or want to see: Steady behaviour would typically propose or want to see:

-

conservative estimates of cost which have been validated by the appropriate stakeholders; -

a detailed assessment of the viability of achieving the objectives and the associated risks; -

funds secured at the earliest point to ensure people are informed and can plan; -

the release of funds to allow people to work in an effective and stress-free manner; -

financial systems which provide consistency and a predictable approach to financial management; -

careful monitoring and control which takes account of stakeholders needs in terms of reporting. Someone exhibiting steady behaviour would typically be perceived as: -

viewing and treating people differently from other resources; -

empathetic to the impact of financial decisions on people; -

cautious as they work through agreed processes and wishing to minimise financial risk; -

indecisive when decisions need to be made in particular when there is uncertainty or time pressures. |  Influential behaviour would typically propose or want to see: Influential behaviour would typically propose or want to see:

-

broad consideration of costs and optimistic estimates that have been discussed and agreed with the relevant stakeholders; -

an assessment of the viability of multiple options before making a decision; -

funds secured as early as practically possible and communicated openly to start the process of pulling the team together; -

the release of funds in advance to allow the team to focus on optimising delivery; -

suitably detailed financial systems which provide information that is easily accessible and discussed before decisions are made; - a collaborative and simple approach to monitoring and control that involves and supports the delivery team.

Someone exhibiting influential behaviour would typically be perceived as: -

innovative and wishing to see people involved in identifying options; -

informal and often working around the processes where seen as constraining; -

fast paced and wishing to see resources starting quickly without being overly burdened by process; -

making decisions based on gut feel and later backing up with data. |

Thanks to Donnie MacNicol of Team Animation for providing this page.

Concientious behaviour would typically propose or want to see:

Concientious behaviour would typically propose or want to see: Dominant behaviour would typically propose or want to see:

Dominant behaviour would typically propose or want to see: Steady behaviour would typically propose or want to see:

Steady behaviour would typically propose or want to see: Influential behaviour would typically propose or want to see:

Influential behaviour would typically propose or want to see: