Good governance of organisations is widely accepted as being vital to their health and longevity. It is defined as:

Good governance of organisations is widely accepted as being vital to their health and longevity. It is defined as:

"the system by which the whole organization is directed, controlled and held accountable to achieve its core purpose over the long term" 1

BS135002 states that corporate governance should:

“…ensure the strategic guidance of the company, the effective monitoring of management by the board, and the board’s accountability to the company and the shareholders.” 2

While the principles are well established, different approaches often emerge in different contexts.

While it can be beneficial to have specialised areas of governance, the risk is that these become isolated and do not integrate effectively. Governance processes should be tailored for different purposes but overall, an organisation’s governance needs to be fully integrated for it to achieve long term success.

The distinction between the BAU and Change portfolios of work, for example can lead to separate governance regimes for finite teams (programmes and projects) and continuous teams (BAU workstreams). This can cause potential integration, prioritisation, resource and finance management difficulties.

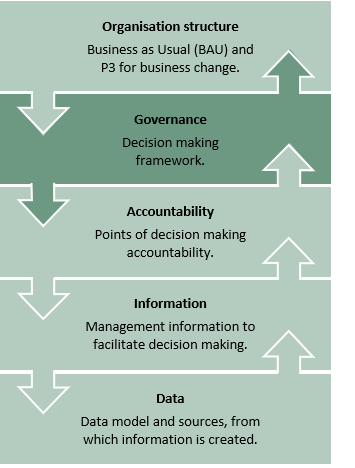

The governance level in BIG describes the overall integrated framework of authority, accountability and relationships that defines and controls the objectives of projects, programmes and portfolios. It also covers the mechanism whereby the investing organisation provides financial, technical and ethical guidance over the deployment of the work and the realisation of benefits.

Business Integrated Governance

In BIG, governance is operated at and between focal points of accountability within the organisation. These ‘Governance Nodes’ can be departments, operational teams, portfolios, programmes, projects etc., typically anywhere there is a business case or a business plan against which to hold accountability. In many cases, it is a person that is accountable, but in some cases, it will be a board, committee or other combination of roles.

While the BAU operating model can be quite a simple hierarchy, responsibilities and accountabilities in portfolios, programmes and projects are generally more complicated.

For example, a project may be sponsored from within one business unit but require resourcing support from others, funding from multiple sources and have several beneficiaries.

BIG ensures a clear line of sight between the apex of governance (the Main Board) and each key governance role with clear accountabilities. Without operationalising governance, administrative time can be extensive, decision making slow and basic business control hampered.

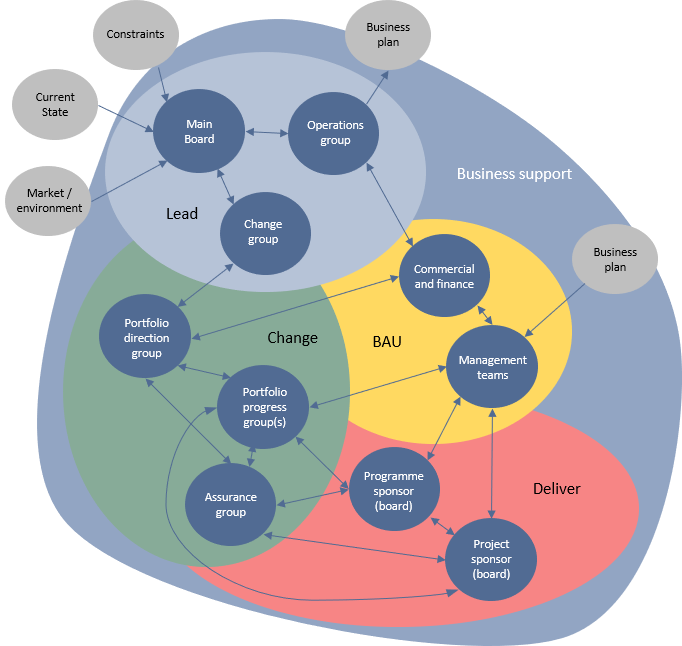

The example below comprises specific defined nodes and roles – an organisation may have similar roles with different titles or groups combined in different ways. It assumes a scenario where a Main Board delegates change to a Change group and operational matters to an Operations group.

The Change group will then delegate change objectives to Portfolio Direction Groups who are each responsible for one portfolio. Similarly, the Operations group will delegate operational targets to management teams. Both may be tasked with addressing challenges cross-functionally.

In larger organisations there may be multiple groups that are set up to carry out the role of Portfolio Direction groups. There may be one per business unit or they may draw from all over the business for cross functional objectives. In smaller organisations the roles outlined above might be undertaken by the same group of individuals fulfilling different roles.

The role of the Portfolio Direction Group (s) is to take ownership of the delegated strategic objectives, provide clear and up to date direction to the delivery of their change portfolio, and be accountable for the realisation of the strategic benefits.

Working with Portfolio Direction Groups would be Portfolio Progress Groups that, as the name implies, focus on oversight of delivery and benefits realisation. In some circumstances these two bodies may comprise the same people.

It is assumed that operational management teams have performance targets, local change needs and participation in corporate transformation initiatives. These could induce a conflict of interest between hitting business targets and collaborating with strategic imperatives.

Therefore, a resource allocation model should be maintained to assure effective and visible prioritisation. Support for, and assurance of, this process is vital and the BIG model includes a theme within the cadence of a management team that provides oversight of resourcing, coordination of escalated issues and benefit realisation across BAU and Change.

Similarly, commercial and finance functions should maintain a funding allocation model that assures effective and visible prioritisation and performance.

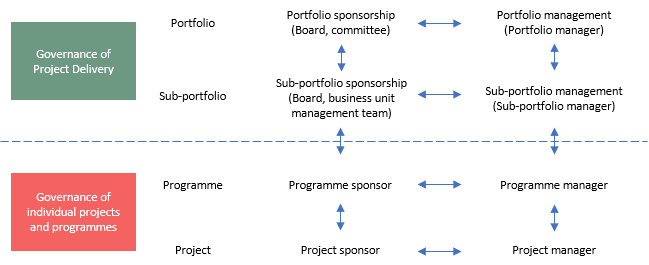

For portfolios, programmes and projects, the governance model provides clear delineation between roles focused on benefits (sponsor) and delivery (manager). It also recognises that in larger organisations the collective or overall portfolio might be broken down into sub-portfolios that are often assigned to each key organisational unit or department.

-

G20/OECD PRINCIPLES OF CORPORATE GOVERNANCE © OECD 2015

- This is the definition of Governance in BS13500 which was used as the basis for ISO37000 Guidance for the Governance of Organisations

Thank you to the Core P3M Data Club for providing this page.