The commercial and finance node recognises that these functions establish rules for accounting, procurement and financial management. They support investment appraisal and risk management, assist with business partnering and services (procurement, contracts etc). They also provide specialist monitoring support for portfolios, programmes and projects pre-delivery, during delivery and post-delivery.

Finance professionals are needed throughout portfolio, programme and project life cycles as integrated team resources and providers of services that the commercial and finance management teams allocate and co-ordinate.

Whether commercial and finance support is provided out of a central function, or from a distributed hub and spoke model, the function can be considered a Management Team. It has objectives and targets and must manage deployment of people across competing priorities for services, secondments or projects. As a Management Team, it has a governance agenda which includes resources and benefits. However, whereas for other management teams, the quality management and service details are out of BIG’s scope, in commercial and finance these are central to BIG.

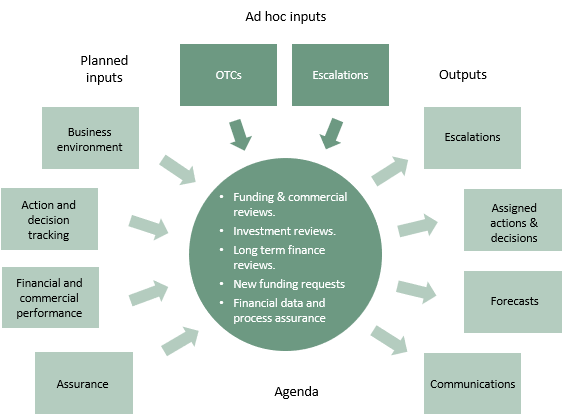

The commercial and finance agenda provides a mechanism to review funding needs (committed and requested) and financial performance across BAU and Change. It also provides a mechanism to review financial performance and provide investment assurance for which finance is accountable.

This agenda enables internal commercial and finance issues and risks to be communicated to projects, programmes and workstreams and vice versa. It will also consider actions and decisions related to investment appraisal, financial KPIs and escalations needed to management teams, portfolios, programmes, projects, workstreams, and Main Board as appropriate.

This agenda should be scheduled to fit with support, assurance and finance processes. The P3 community expects to work in harmony with the commercial and finance functions in delivering and receiving a quality service.

| Inputs | Agenda | Outputs |

|---|---|---|

MI that covers regular performance, forecasts and ad hoc inputs. Finance allocations; forecast demand; actual expenditure; future fund availability. Assurance and approval requirements. Priorities for BAU and Change (Objectives, Targets and Challenges) Finance and commercial escalations. Benefit realisation forecasts. Information on new and ongoing OTIGs relevant to the commercial and finance teams. Business constraints. Progress on actions and decisions. | Progress and status: Review:

Forecasting:

Enablers:

| Actions and decisions assigned to owners including priorities for funding allocations. Escalations and Main Board where funding demands, revenue forecasts and benefit expectations cannot be met. Communications to portfolio, programme, management teams, business support, sponsors, projects and workstreams. |

Depending on the size and number of portfolios, the commercial and finance review is one or many sub reviews. Each agenda is broken down into sections, wherein topics are listed, and described. Outputs are primarily risk and issue updates, actions (for example escalation to Main Board, portfolio, management teams) and decisions.

Thank you to the Core P3M Data Club for providing this page.