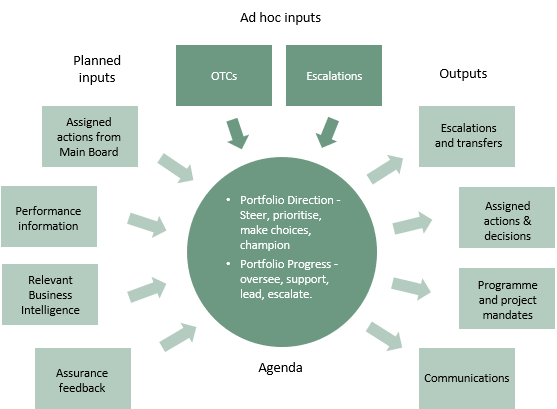

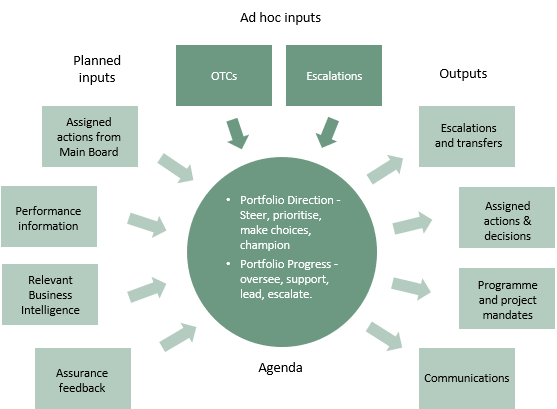

The portfolio node is the key conduit between Main Board and the rest of the organisation. It translates and prioritises the OTCs assigned into delivery entities (e.g. programmes, projects, workstreams, products) with appropriate objectives (targets, benefits and outcomes).

Portfolios must be ready to respond to shifts in Main Board priorities for OTCs, changes in the environment and any risk that emerges during delivery.

The portfolio agenda decides what is in the portfolio and how it is achieved. They prioritise and balance deployment of funds and resources within the portfolio. Where necessary issues are escalated to the Main Board, transferred to other portfolios or delegated to management teams.

In larger organisations this node’s responsibilities and accountabilities may be divided between a Portfolio Direction Group (PDG) and a Portfolio Progress Group (PPG) as shown in the tables below:

Portfolio Direction Group:

| Inputs | Agenda | Outputs |

-

MI that covers regular performance, forecasts and ad hoc inputs.

-

Overall portfolio progress, performance, accomplishment, escalations and exceptions.

-

Review of cost and resource performance.

-

Information on new and ongoing OTIGs relevant to the portfolio.

-

Delegated OTCs from Main Board.

-

Progress on OTCs from PPG including specific issue escalations (e.g. customer, staff, funding, resourcing related). -

Progress on actions and decisions. | Progress and Status: Enablers:

Forecasting:

-

Focus on outcomes and confidence trends in their achievement.

-

Reviews of forecast costs, resources, issues and risks

-

Confirm priorities.

-

Balance finance and resources. | -

Agreed OTCs for the portfolio and their priorities.

-

Actions, decisions and risks assigned to owners including guidance for delivery, funding and resourcing choices. -

Communications to Main Board, management teams, commercial and finance operations, business support, sponsors. |

Portfolio Progress Group:

| Inputs | Agenda | Outputs |

-

MI that covers regular performance, forecasts and ad hoc inputs.

-

Overall portfolio progress, performance, accomplishment, escalations and exceptions.

-

Review of cost and resource performance.

-

Information on new and ongoing OTIGs relevant to the portfolio.

-

Progress on OTCs from programmes, projects and BAU workstreams including specific issue escalations (e.g. customer, staff, funding, resourcing related) -

Progress on actions and decisions. | - Progress and Status:

Look backwards, focus on historical trends and last period delivery.

Review: - performance, issues, accomplishment, escalations and exceptions, cost and resource performance;

- additional proposals for potential inclusion in the portfolio;

- assurance escalations.

Enablers:

Review: - objectives (e.g. changes in underlying drivers)

- efficiency and effectiveness trends

- lessons learned realisation

- culture and ethics

- satisfaction reviews (staff, customers)

- portfolio balance.

Forecasting:

- consider changes to strategic direction, marketplace changes, risk changes, etc.

Review: - risk and confidence in objectives;

- cost and resources estimates;

- confirm priorities and balance of finance and resources

- address escalated issues.

- conclude and communicate decisions and actions.

| -

Outcomes, key results and benefit targets.

Actions, decisions, risks and priorities assigned programmes, projects and workstreams. -

Feedback to PDG, management teams, commercial and finance functions, business support, sponsors, programmes, projects and workstreams. |

Thank you to the Core P3M Data Club for providing this page.