General

Financial management covers all aspects of obtaining, deploying and controlling financial resources. The goals of financial management are to:

- estimate the cost of achieving the objectives;

- assess the viability of achieving the objectives;

- secure funds and manage their release throughout the life cycle;

- set up and run financial systems;

- monitor and control expenditure.

Financial management is made up of three main areas:

-

Investment appraisal is the procedure by which the viability of the work is assessed. This is one of the primary inputs to the business case.

-

Funding is concerned with securing the investment required to complete the work and ensuring it supports cash flow.

-

Budgeting and cost control estimates costs, predicts cash flow and then applies controls to monitor cash flow.

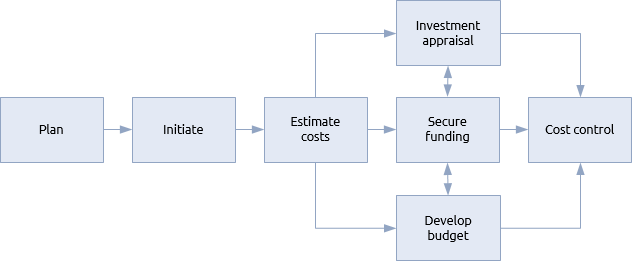

The management of finance on projects, programmes and portfolios takes many different forms but a simple procedure is shown below:

The procedure starts with the planning step that defines the scope and objectives of financial management and results in the finance management plan. The initiation step is performed once the work is approved and the resources needed to manage finances are mobilised.

The first specific step is to estimate what the work may cost. Cost estimates are made and refined in parallel with other planning procedures that establish the scope of work and estimate schedules, resources and risk.

The estimated costs are balanced against the value of benefits (as calculated in the benefits management procedure) and documented in the business case. Work is approved if it can be shown not only that the benefits outweigh the costs but also that the organisation cannot get a better return by investing the same funds elsewhere.

Estimated costs will be collated onto budgets for different aspects of the work. These are combined with the delivery schedule to create cash flow information. Additional budgets may be created to deal with contingency and a reserve to be held by the sponsor.

The exercise of securing funds continues in parallel with these steps and with the different phases of the life cycle. For example, when a mandate triggers the identification phase of a project or programme, it should come with sufficient funding to complete the identification process.

If the brief is approved at the end of the identification process, that approval should be accompanied by sufficient confirmed funds to complete the definition process and sufficient funds in principle to complete the work.

As the work proceeds and the amount of money involved increases, financial control systems need to be implemented that are consistent with the volume and nature of financial transactions. These systems will work in conjunction with schedule management systems to predict cash flow and then track actual expenditure against budget.

The approach to financial management within a project, programme or portfolio is highly dependent upon the policies, procedures and standards used in the host organisation. These, in turn, are affected by the regulatory and legislative environment. At the outset, financial procedures must be set out in the finance management plan that comply with all appropriate standards and enable exchange of information with the host organisation’s financial systems.

Projects, programmes and portfolios

Financial management systems need to be appropriate to the scale and complexity of the work. This can range from a small project within a department to a highly complex portfolio of international projects and programmes owned by partner organisations. Regardless of scale and complexity the fundamental principle is always that costs must be controlled and checked to ensure they are not predicted to exceed the value of expected benefits.

Smaller projects will not justify investment in their own financial systems and will use the systems of the host organisation. This can lead to problems where the financial systems are configured to report on an operational basis and do not easily facilitate the type of cost breakdown needed for a project.

More mature organisations will ensure that their corporate financial systems can exchange data with project systems for scheduling.

Larger projects and programmes may be able to justify dedicated financial management systems and portfolios should certainly have this capability. These systems will need to consolidate financial data from different sources, such as the component projects, business-as-usual activity and the top level management infrastructure.

Finance and accounting policies need to be consistent and this is a particular challenge where the work is international, multi-company or both.