General

Risk context addresses the individual and group attitudes and behaviours that affect the way risk arises and how it may be managed.

This context can be viewed as having two components: risk attitude and risk appetite.

Risk attitude describes an individual or group’s natural reaction to uncertainty of any type. This is dependent upon people’s perception of risk which, in turn, is influenced by a range of factors at both the conscious and unconscious level.

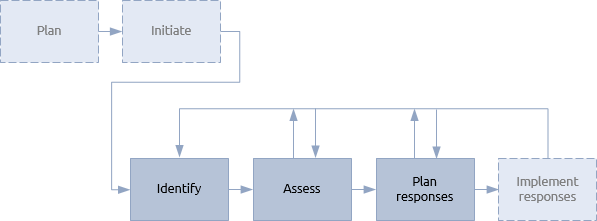

The effect of risk attitude is most evident during the response planning step in the risk management procedure where it will influence the way people think a risk should be addressed.

Attitudes can be classified in three ways: risk averse, risk neutral and risk seeking.

As the name suggests, risk averse people don’t like taking risks. In some cases this is a positive benefit. When planning work that is risky in a health and safety context or perhaps when working to provide relief in a war zone, being risk averse is definitely an advantage. It will not eliminate the inherent risk but it means the planner will adopt a very cautious approach to planning risk responses.

In some instances being risk averse is a disadvantage. If a project is developing products for an entrepreneurial technology company in a fast moving and competitive commercial environment, being risk averse is unlikely to help. In this situation, planners need to be more at the risk seeking end of the spectrum.

Risk attitude can have a major impact on the assessment step particularly when qualitative risk techniques are being used. Someone who is naturally risk averse may estimate the probability and impact of a risk event as higher than someone who is naturally risk seeking. Where major risks need to be assessed accurately, techniques such as Delphi can help reconcile the different risk attitudes of the individuals involved.

As in so many roles, the task facing the individual is to reconcile their natural predisposition towards uncertainty with the needs of the work at hand. Perhaps being risk neutral is the best personal attribute on the grounds that it will be easier to move to aversion or seeking as the context demands.

Appetite represents the amount of risk that an individual or organisation is prepared to take in order to achieve their objectives and is most evident in the identification step of the procedure. It may be obvious that the entrepreneurial technology company mentioned above will have a high risk appetite in order to achieve its objective of quickly getting innovative new products to market. Less obvious is that the charity that delivers aid to a war zone must also have a high risk appetite. Without it they would stay at home and not risk being shot at.

This highlights the difference between risk attitude and risk appetite. Both must reflect the prevailing context of the work.

A P3 manager needs to understand the host organisation’s risk appetite as it applies to the work and the risk attitudes of the team members and stakeholders. During the definition process functions such as solutions development will be heavily influenced by the stakeholders’ risk appetite. Some ways of meeting requirements may be delivered quickly or produce high returns but also involve high levels of risk. These would be acceptable to risk seeking stakeholders but not to those who are risk averse. Not all stakeholders will be the same.

Projects, programmes and portfolios

A very obvious difference between small projects at one end of the scale and portfolios at the other end is the number of people involved. While the range of people involved in a portfolio is likely to encompass all points on the risk attitude spectrum, a project is very dependent on the attitudes of its manager and sponsor.

Therefore, at the less complex end of the spectrum, the manager and sponsor must be very self-aware and control their instincts to match the needs of the project. At the complex end of the spectrum the management team must work to manage the myriad different attitudes to match the needs of the programme or portfolio.

Where the work involves multiple organisations, the P3 manager will need to balance the needs of different groups of stakeholders. For example, where a project is being delivered by a contractor on behalf of a client, there may be different appetites for risk. The contractor may be risk averse in order to protect profit on the contract, whereas the client may be risk seeking if there are opportunities to increase the value of the project’s output.

This can add an ethical dimension to the context. A project manager may identify risk that affects the value of the output to their client but not the contractor’s profit. If the means of responding to the risk adversely affects the contractor’s profit they may be reluctant to highlight this.

It is to be hoped that increasing professionalism in P3 management means that the project manager acts in the best interests of the client and the client recognises this in their dealing with the contractor. The same sort of principle can apply to project managers within a programme.

Programme and portfolio management teams must ensure that the acceptable level of risk for the work as a whole is reflected in the risk management of individual projects and programmes. This does not mean that every project or programme will need to have the same risk appetite, but they must be categorised, prioritised and balanced with the overall acceptable level of risk in mind.