General

Funding is the means by which the finance required to undertake a project, programme or portfolio is secured and made available to perform the work. Its goals are to:

- determine the best way to fund the work;

- secure commitment from the fund holders;

- manage the release of funds throughout the life cycle.

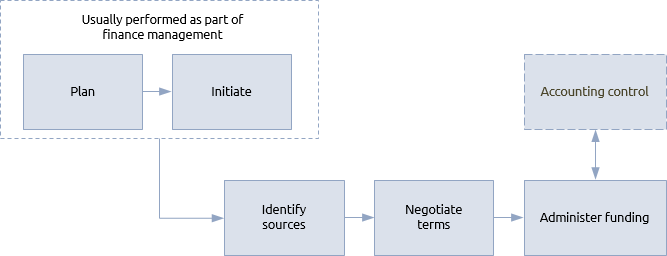

Typical steps involved in the funding procedure are:

The first step in the procedure is to identify the possible sources of funding. These could be from internal or external sources or a combination of both. The scale of funding may be as simple as allocation of funds from a single departmental budget or as complex as international financing of a joint venture. In some cases the work may be expected to be self-funding, with revenues generated from earlier stages of work providing funds to deliver the later stages.

Internal funding is where all the costs of the work are funded from the host organisation’s existing resources in operational and capital budgets. It is unlikely that terms need to be negotiated for internal funding but conditions may be applied and recorded in the finance management plan.

Where funding is provided by an external body such as a bank or by shareholders, terms and conditions will need to be negotiated. This can include interest rates, charges and procedures for release of funds. Complex funding arrangements may need the management team to have access to specialist expertise.

Through the life cycle, as plans are defined in ever greater detail with increasing levels of confidence, funds will be fully committed and approval given to commence work.

Administering funds therefore involves:

-

initially: committing funds for the identification process and reserving funds for the definition process;

-

at the end of identification: committing funds for the definition and reserving funds for the delivery process;

-

at the end of the definition: committing funds for delivery, or at least the first stage or tranche of work;

-

at each review: funds for the next stage or tranche will be dependent upon a viable business case.

Whether internal or external, recipients of benefits or not, funders must be treated as key stakeholders and managed accordingly.

Projects, programmes and portfolios

Smaller projects tend to exist within departmental boundaries. They will be funded from a single departmental operational budget and the project sponsor may well be the departmental manager who owns that budget. As projects become larger they cross departmental boundaries and draw upon multiple budgets. The project sponsor is then more likely to be someone who is impartial and acceptable to the various budget holders. A project board may be formed to give representation to the key funding providers. Organisation management will take these factors in to account when designing the organisational structure.

In situations where a contractor is delivering a project on behalf of a client, the contractor’s funding comes from the client (who may well have their own external sources to manage). Payments from the client to the contractor will usually be based on valuations of work done at agreed points, either at key milestones or regular periods. The contactor will often need bridging finance in place to cover the time delay between paying bills and receiving funds based on valuations.

In some countries, there are funding arrangements that have been put in place by government to form partnerships with the private sector for major infrastructure projects. Many of these are principally procurement tools, designed to harness private sector management, expertise and resources in the delivery of public services, while reducing the impact on public sector borrowing. Others are ownership structures in which the government retains equity stake in the asset.

Build, own, operate, transfer (BOOT) arrangements can be applied to a private sector initiative as well as a public-private sector one. In a BOOT project one organisation is given a concession from the commissioning organisation to fund, build, operate and eventually transfer a facility.

Programmes are very likely to involve multiple internal budgets. Even where a strategic programme may be funded from central corporate resources, there will be change management activity in business as usual that is usually funded by the departments involved.

Having secured funding for the programme, the programme management team are responsible for distributing funds to the component projects. They must always be aware that they are really funding the delivery of benefits, the projects are simply the means of creating the outputs that enable the benefits to be realised. With the focus on the overall business case funds will be allocated and re-allocated in accordance with the benefits they create. This may involve moving funds between projects, re-scoping projects or even their cancellation in order to use funds more effectively.

Standard portfolios are often made up of projects delivered for clients. Most of the portfolio budget is simply the aggregation of the various project budgets. However, managing the client projects as a portfolio may provide the opportunity to use the cash flow of some projects to bridge the finance for others, thus avoiding the need for more expensive external funds.

A strategic portfolio is funded as part of the business planning cycle. Ideally, the objectives of the portfolio will be delivered within the same time frame. If not, the portfolio runs the risk of having its funding changed in the next business planning cycle and with it the continued funding of projects and programmes.

The prioritisation and balancing of projects and programmes within a strategic portfolio will, to a large degree, depend upon how it is funded. For example, there may be levels of uncertainty regarding future availability of funding. Long-term secured funds should be used for the longer, high-priority programmes, while short-term funds will be matched to shorter-term projects or smaller programmes.