When using discounted cash flows, the internal rate of return (IRR) is the discount rate that gives a net present value of zero.

Broadly speaking the IRR is the rate of growth delivered by a project or programme. The higher the IRR the more attractive the business case. In pure financial investment terms, if the IRR for a project or programme is not greater than the return that could be achieved by investing the equivalent sum of cash in the financial markets, it isn’t worth undertaking the work.

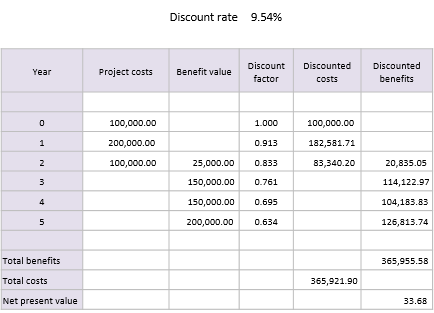

The table above shows the same cash flows used in the discounted cash flow example but the discount rate has been adjusted to get as close as possible to a net present value of zero using two decimal places. All other things being equal, projects with a lower IRR would be less attractive and those with a higher IRR would be more attractive.