Payment methods define the basis on which a client will pay a contractor for work done on a project. The main difference between methods is where the risk lies.

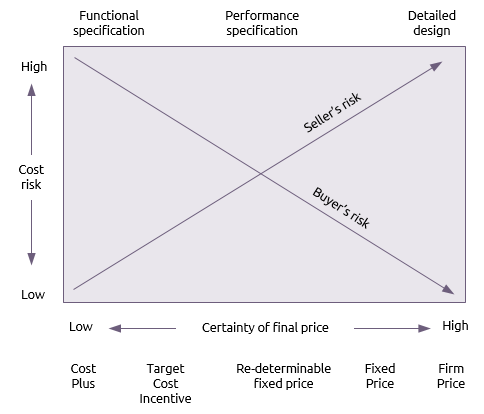

In the diagram below, the vertical axis represents risk and the arrows indicate how the buyer’s (client’s) risk increases as the seller’s (contractor’s) risk decreases.

The horizontal scale represents the certainty of the final cost (in terms of what the buyer actually pays). It then shows two things. Firstly, at the bottom, are example payment methods in order of increasing certainty of final price.

Secondly, at the top, are broad indicators of the degree to which the specification is defined.

In simple terms, a seller should only be prepared to give a firm price against a detailed specification but may seek a cost plus arrangement if only a functional specification is provided.

There are many forms of payment method, only some of which are described below:

- Firm Price

-

A fixed price is agreed for a fixed specification. The difference between a firm price and a fixed price is that a firm price contract does not permit changes to the agreed specification.

- Fixed Price

-

A fixed price is agreed for a fixed specification. Changes are allowed to the agreed specification but are reimbursed on a cost plus basis.

- Re-determinable Fixed Price

-

A fixed price contract that includes provision for revising prices according to pre-agreed terms, for example, to accommodate the effect of inflation on raw materials.

- Target Cost Incentive

-

An estimated target cost is set and cost overruns or cost savings are shared between the buyer and seller.

- Cost Plus

- The buyer pays the seller the cost of performing the work plus a fee to cover overheads and profit.