Discounted cash flow (DCF) is an investment appraisal technique that, unlike payback or accounting rate of return, takes the value of money over time into account.

The basic principle is that £1,000 today doesn’t have the same value (in terms of what it can buy) as it does next year.

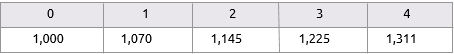

Most people are familiar with the idea of investing a sum of money so that it attracts interest. If £1,000 were invested at 7% it would grow accordingly, so that in four years’ time it was £1,311.

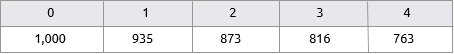

Economic inflation has the opposite effect. £1,000 placed in a box under the mattress will decrease in value. If inflation were 7% its value would decrease accordingly.

To find out how much £1,000 is worth in four years’ time the initial sum is multiplied by the discount factor, which varies according to the assumed discount rate. The result is called the present value. In this example:

- the initial sum is £1,000;

- the assumed discount rate is 7%;

- therefore the discount factor is 0.763 (1.000 divided by 1.07 four times)

- therefore the present value is £763.

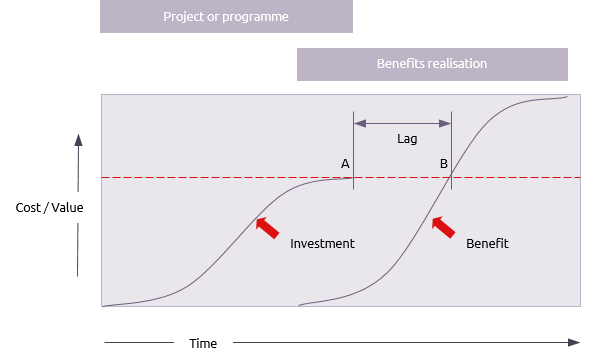

This is important to projects and programmes because they spend cash and create benefits that have a cash value, but over a period of time.

The pattern of expenditure and the pattern of benefits realisation (in monetary terms) will typically form s-curves with a lag between them. When preparing a business case for a more complex project or programme, it isn’t sufficient to add up all the costs and compare them to the sum of the value of benefits, because they do not occur at the same time.

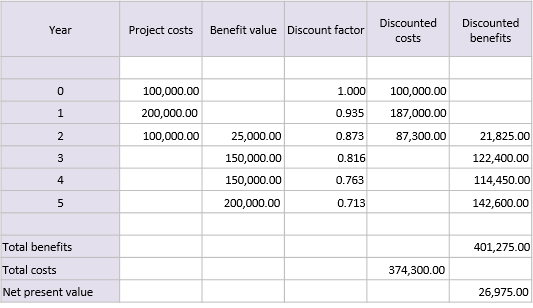

The table below shows project costs and benefits discounted according to the year in which they occur. The costs and benefits are summed and the difference represents the net present value, i.e. the net value of undertaking the project in terms of today’s value of money.

A table like the one above is suitable for a non-complex project delivering one benefit. In more complex projects or in programmes it is not so simple to relate one project and its output to one benefit.

At programme level is it likely that there will be multiple project cash flows and multiple benefit cash flows that would be aggregated to provide an overall programme discounted cash flow and net present value.