The accounting rate of return (ARR) is a simple investment appraisal technique for evaluating less complex projects and their benefits.

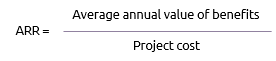

The formula as expressed in accounting terms is:

In P3 Management terms this could be expressed as:

Therefore, in simple terms, if a project cost £1m and produced benefits that averaged £150,000 per annum thereafter, the ARR would be 15%.

Of course, when the business case is first prepared the project cost and value of benefits are both estimates of varying accuracy. As the work progresses the estimates can be updated and ARR could therefore be a key performance indicator of the project’s continuing viability. If regularly updated, it could be used in the boundaries process as part of the go/no go assessment.

Click here for a worked example from Brook Bicycles' Columbus project.

A key factor that is ignored in ARR is how the value of money changes over time, i.e. in an economy that has price inflation; the value of money earned today is different to the same amount earned in five years’ time. This is taken into account in more sophisticated discounted cash flow methods such as net present value and internal rate of return.